By Toma Imirhe

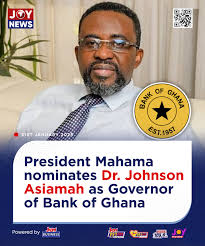

President John Dramani Mahama has nominated Dr. Johnson Asiamah to serve as Governor of the Bank of Ghana pending approval by the Council of State.

Dr Asiamah’s nomination follows the receipt and acceptance of a formal request by current Governor, Dr. Ernest Addison, to proceed on leave from Monday, February 3, leading to his retirement on 31st March, 2025 when his second four year term in office expires.

Dr Johnson Asiamah who previously served as a Second Deputy Governor of the Bank of Ghana between 2016 and 2017, holds a PhD in Economics from the University of Southampton, UK and has extensive experience in monetary policy formulation, financial stability regulation and economic research having worked at the central bank for over 23 years.

Highly respected in the local and international financial services industry for being a career central banking professional rather than simply a favoured political career. He has over the years demonstrated commitment to implementing sound monetary and exchange rate policy, foster a stable financial system, as well as promoting accelerated economic growth in Ghana.

But his appointment is seen as redemption after a difficult past seven years. After being hounded out of his contractual position as second Deputy Governor in 2017, by the now outgone Nana Akufo-Addo administration, he has since been prosecuted – unsuccessfully – over two separate cases related to the collapse of UniBank and UT Bank. He was accused by that government of breaching the Bank of Ghana Act and causing financial loss, due to his signing off on providing central bank liquidity support of GHc150 million to the now defunct Unibank and GHc 413.09 million to the also now defunct UT Bank, despite both decisions being recommended by the BoG’s Banking Supervision Department.

However, the case was widely seen as political persecution for his role in defending some decisions of the bank and the state under the first President John Dramani Mahama administration; an assertion supported by the circumstances of the case and the fact that seven years on, no guilty verdict has been secured. Instructively upon the assumption of office of President Mahama for a belated second term in early January, a notice of withdrawal of the case was filed at the trial court and signed by the Director of Public Prosecutions (DPP), Yvonne Atakora Obuobisa.

Meanwhile, the outgoing Governor of the Bank of Ghana (BoG), Dr. Ernest Addison will from Monday February 3, 2025 proceed on a terminal leave as he prepares for retirement. Dr. Addison who has served as Governor since April 2017 is embarking on the leave ahead of his official exit on March 28, 2025, after successfully serving two full terms. This move aligns with the Bank of Ghana Act, 2002 (Act 612), as amended, which stipulates that the Governor’s tenure is a four-year term, renewable only once.

The Governor’s leave has received the approval of President John Dramani Mahama. Dr. Ernest Addison was first appointed on April 3, 2017 and was reappointed for a second term on March 29, 2021.

Interestingly, Dr Addison has also been publicly villainized for political reasons too, having been accused of supporting the Akufo-Addo administration’s profligate public spending by lending it money far in excess of what the laws permit in 2022 and then writing off half of it, leading to the erosion of most of the central bank’s capital. In actual fact though, the BoG, under Dr Addison, provided government with the money to prevent its defaulting massively on due public debt repayments when the international capital markets closed its doors to Ghana; and then accepted a 50% haircut on its enlarged exposure to government to enable government meet the public debt sustainability threshold demanded by the International Monetary Fund before it approved a direly needed US$3 billion financial bailout for the country

President Mahama has pledged to overcome public discontent by boosting the economy and creating much-needed jobs. He inherited an economy emerging from its worst economic crisis in a generation, with turmoil in the vital cocoa and gold industries.

His administration has yet to formally publish its detailed macro-economic policy plans, which was cited by the central bank a week ago as one reason why it kept its key lending rate, the Monetary Policy Rate unchanged at 27%.

The Bank of Ghana targets inflation of 8% with a margin of error of 2 percentage points either side of that, but the annual rate was currently well above that at over 23% in December.

The bank said last week that its latest forecasts showed it would take longer for inflation to return within the 6%-10% range than originally anticipated, and is now targeting the second quarter of 2026 to reach it..